Employment image

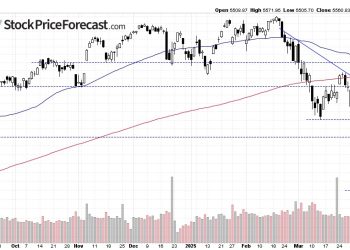

Wall Road has now recovered almost all of the losses seen since “Liberation Day,” however the Federal Reserve’s job is getting so much tougher. The “data-dependent” central financial institution could have a tough time parsing by way of current financial information earlier than it meets subsequent week, given the adverse GDP studying that wasn’t actually adverse and scorching inflation information that may not have been all that fiery. Subsequent up is the doubtless market-moving nonfarm payrolls report, which will probably be printed at the moment at 8:30 AM ET.

Snapshot: The common estimate of economists sees 130K added to U.S. payrolls, down from the 228K improve in March. Traders will even be taking a look at whether or not the March determine is revised decrease, on condition that final month’s report got here in a lot stronger than anticipated. The unemployment price, although, is anticipated to stay at 4.2%, nonetheless close to historic lows, whereas common hourly earnings are anticipated to rise 0.3% M/M, the identical price as in March. On a year-over-year foundation, that interprets to a 3.9% improve, up from 3.8% within the prior month.

Do not make any huge bets on market route. If the numbers are available weak, that will be a foul signal for the economic system, and shares may head south on the information. Alternatively, it would imply the Fed might be extra inclined to step in sooner, and equities may rally on the hope of price cuts. The identical equations can happen if the numbers are available stronger than anticipated, so it is not a good suggestion to wager an excessive amount of on the result of at the moment’s report.

SA commentary: “The present labor market will be greatest described as a low-hire-low-fire market,” writes SA analyst Damir Tokic. “Plainly the labor market remains to be not weak sufficient to level to an imminent recession, on condition that corporations are nonetheless reluctant to let go of their staff. This seemingly has to do with a continual U.S. labor scarcity, particularly as a result of at the moment stricter immigration coverage. Thus, it’s seemingly that the non-farm labor jobs for April stay optimistic. Nonetheless, the query is whether or not new jobs are nonetheless being created, in combination.”

Employment image

Wall Road has now recovered almost all of the losses seen since “Liberation Day,” however the Federal Reserve’s job is getting so much tougher. The “data-dependent” central financial institution could have a tough time parsing by way of current financial information earlier than it meets subsequent week, given the adverse GDP studying that wasn’t actually adverse and scorching inflation information that may not have been all that fiery. Subsequent up is the doubtless market-moving nonfarm payrolls report, which will probably be printed at the moment at 8:30 AM ET.

Snapshot: The common estimate of economists sees 130K added to U.S. payrolls, down from the 228K improve in March. Traders will even be taking a look at whether or not the March determine is revised decrease, on condition that final month’s report got here in a lot stronger than anticipated. The unemployment price, although, is anticipated to stay at 4.2%, nonetheless close to historic lows, whereas common hourly earnings are anticipated to rise 0.3% M/M, the identical price as in March. On a year-over-year foundation, that interprets to a 3.9% improve, up from 3.8% within the prior month.

Do not make any huge bets on market route. If the numbers are available weak, that will be a foul signal for the economic system, and shares may head south on the information. Alternatively, it would imply the Fed might be extra inclined to step in sooner, and equities may rally on the hope of price cuts. The identical equations can happen if the numbers are available stronger than anticipated, so it is not a good suggestion to wager an excessive amount of on the result of at the moment’s report.

SA commentary: “The present labor market will be greatest described as a low-hire-low-fire market,” writes SA analyst Damir Tokic. “Plainly the labor market remains to be not weak sufficient to level to an imminent recession, on condition that corporations are nonetheless reluctant to let go of their staff. This seemingly has to do with a continual U.S. labor scarcity, particularly as a result of at the moment stricter immigration coverage. Thus, it’s seemingly that the non-farm labor jobs for April stay optimistic. Nonetheless, the query is whether or not new jobs are nonetheless being created, in combination.”