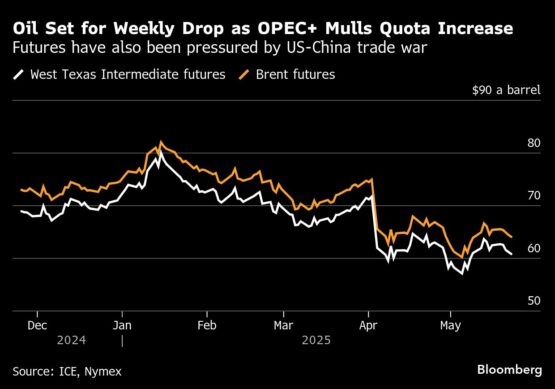

Oil headed for its first weekly decline in three, as OPEC+ weighed one other bumper manufacturing improve that might add provides right into a market already anticipated to face a glut.

Brent fell towards $64 a barrel, declining for a fourth session and bringing its weekly loss to about 2%. West Texas Intermediate was beneath $61. OPEC and its allies mentioned one other main output-quota improve of 411,000 barrels a day for July, though no settlement has but been made, delegates mentioned.

ADVERTISEMENT

CONTINUE READING BELOW

Crude has shed about 14% this 12 months, hitting the bottom since 2021 final month, as OPEC+ loosened provide curbs at a faster-than-expected tempo, simply because the US-led commerce struggle posed headwinds for demand. Knowledge this week confirmed one other rise in US business oil stockpiles, including to issues a couple of surplus.

“Focus is more and more turning to OPEC+ and what the group decides to do with July output ranges,” mentioned Warren Patterson, head of commodities technique for ING Groep NV. “One other giant improve for July would cement a shift in coverage — from defending costs to defending market share.”

A gaggle of eight key OPEC+ nations, together with de facto group chief Saudi Arabia, will maintain a digital assembly on June 1 to determine on July’s manufacturing ranges. A Bloomberg survey of merchants and analysts confirmed that the majority anticipated an output quota surge.

Elsewhere, the European Fee’s economic system chief Valdis Dombrovskis mentioned it could be acceptable to decrease the value cap on Russian oil to $50 a barrel. The present $60 cap — a transfer meant to punish Moscow for its struggle in opposition to Ukraine, whereas maintaining the oil flowing — isn’t hurting the producer given decrease costs for now, he added.

ADVERTISEMENT:

CONTINUE READING BELOW

| Costs: |

|---|

|

© 2025 Bloomberg

Comply with Moneyweb’s in-depth finance and enterprise information on WhatsApp right here.

Oil headed for its first weekly decline in three, as OPEC+ weighed one other bumper manufacturing improve that might add provides right into a market already anticipated to face a glut.

Brent fell towards $64 a barrel, declining for a fourth session and bringing its weekly loss to about 2%. West Texas Intermediate was beneath $61. OPEC and its allies mentioned one other main output-quota improve of 411,000 barrels a day for July, though no settlement has but been made, delegates mentioned.

ADVERTISEMENT

CONTINUE READING BELOW

Crude has shed about 14% this 12 months, hitting the bottom since 2021 final month, as OPEC+ loosened provide curbs at a faster-than-expected tempo, simply because the US-led commerce struggle posed headwinds for demand. Knowledge this week confirmed one other rise in US business oil stockpiles, including to issues a couple of surplus.

“Focus is more and more turning to OPEC+ and what the group decides to do with July output ranges,” mentioned Warren Patterson, head of commodities technique for ING Groep NV. “One other giant improve for July would cement a shift in coverage — from defending costs to defending market share.”

A gaggle of eight key OPEC+ nations, together with de facto group chief Saudi Arabia, will maintain a digital assembly on June 1 to determine on July’s manufacturing ranges. A Bloomberg survey of merchants and analysts confirmed that the majority anticipated an output quota surge.

Elsewhere, the European Fee’s economic system chief Valdis Dombrovskis mentioned it could be acceptable to decrease the value cap on Russian oil to $50 a barrel. The present $60 cap — a transfer meant to punish Moscow for its struggle in opposition to Ukraine, whereas maintaining the oil flowing — isn’t hurting the producer given decrease costs for now, he added.

ADVERTISEMENT:

CONTINUE READING BELOW

| Costs: |

|---|

|

© 2025 Bloomberg

Comply with Moneyweb’s in-depth finance and enterprise information on WhatsApp right here.