Within the final three years, each time the shares of IT majors — TCS, Infosys, Wipro — have risen, they’ve carried out so solely to fall once more such that their returns are largely flat on this interval whereas the Nifty has zoomed 50%.

With the Nifty 50 scaling 25,000 on Friday and persevering with its journey of recouping misplaced floor from its September 2024 peak, traders in main IT shares proceed to look at from behind. Within the final three years, each time the shares of IT majors — TCS, Infosys, Wipro — have risen, they’ve carried out so solely to fall once more such that their returns are largely flat on this interval whereas the Nifty has zoomed 50 per cent.

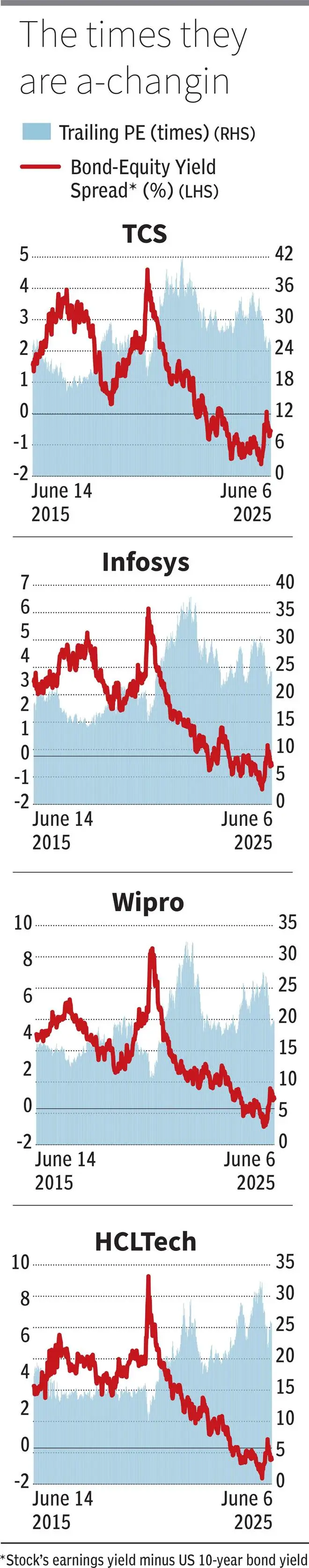

Following this, traders can be tempted to assume ‘is the correction over?’ Whereas there was a extreme timewise correction in shares, sadly by one metric they’re of their costliest zone within the final 10 years! This will proceed to weigh on shareholder returns.

It’s all relative

The interval since GFC triggered the part of worldwide investor’s starvation for yields as rates of interest in developed markets dropped to close zero and even adverse ranges. In comparison with a 10-year authorities bonds yielding 0 to 2 per cent, even shares with PE of 30 instances or earnings yield (1/PE) of three.3 per cent (usually seen costly within the pre GFC period) instantly appeared engaging. So long as the earnings yield was above the federal government bond yield, and it additionally got here with first rate and constant earnings development, such shares discovered robust favour. IT shares neatly fitted into this spot.

The charts examine the bond-equity yield unfold for the IT shares from the angle of a international investor, which is the inventory’s earnings yield minus the US 10-year bond yield, for the final 10 years. By this measure though inventory valuations (barring HCLTech) have corrected considerably from highs, the irony is that on a relative foundation they’re hovering round their costliest ranges within the final 10 years.

Take TCS – its PE in the present day is bang the place it was 10 years again, but when in comparison with different investible choices from an FPI perspective it’s unattractive versus 10 years again. Not solely this, equally on the unfavourable facet is its development prospects in the present day. In FY2015, TCS delivered fixed forex (CC) income development of 17 per cent — that alone by itself sufficiently justified a 25x PE, leaving aside the engaging bond-equity yield unfold. On the contrary, its CC income development in FY25 was simply 4.2 per cent.

Not simply TCS, however for its main contemporaries as nicely — Infosys, Wipro and HCLTech — the interval FY24-27 will rank amongst their worst three-year interval when it comes to development. On this context, with bond yields globally on the rise and offering engaging yields, it’d make FPIs look previous these shares.

Starvation for development

As in comparison with starvation for yields within the period of low rates of interest, international traders are actually hungry for development. Excessive payout ratios — like these seen in IT majors that distribute most of their income to shareholders as a substitute of reinvesting for development in new companies — labored nicely earlier, however could now put strain on these firms.

As their core IT companies enterprise faces competitors from GCCs, mid-cap IT gamers and, extra importantly, AI-related disruption, development could stay lacklustre. Sluggish development for 3 consecutive years may additionally replicate structural modifications past cyclical elements.

Buyers will probably be prepared to purchase shares/indices with low or adverse bond-equity yield unfold if the expansion prospects are shiny, however presently that’s lacking for IT majors.

Revealed on June 7, 2025