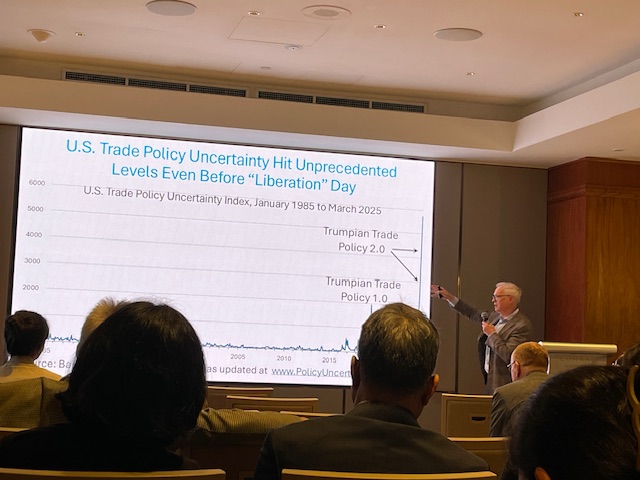

I used to be at a convention — truly two — in Singapore: the Asian Bureau for Finance and Financial Analysis annual convention, and the Asian Financial Coverage Discussion board. Within the first, I attended a chat by Steven Davis (Hoover), on “Measuring Coverage Uncertainty, Assessing its Penalties”. One slide just about summed up my emotions about these instances…

The dialogue actually centered on new analysis, relating to jumps in fairness costs and their determinants.

Within the Asian Financial Coverage Discussion board, Adam Posen (Peterson IIE) kicked off the day’s displays, noting the fragmentation into blocs would find yourself dissipating the advantages we loved within the wake of the autumn of the Soviet empire.

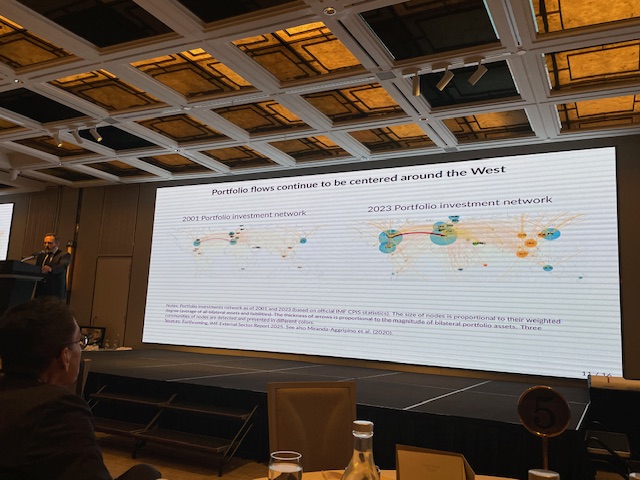

Pierre Olivier Gourinchas (IMF Analysis) supplied insights into ongoing work on … geopolitical fragmentation of the worldwide financial system. This shot reveals the divergence between commerce and finance networks.

Apologies for the poor pictures (Good factor I aimed for a profession in economics…).

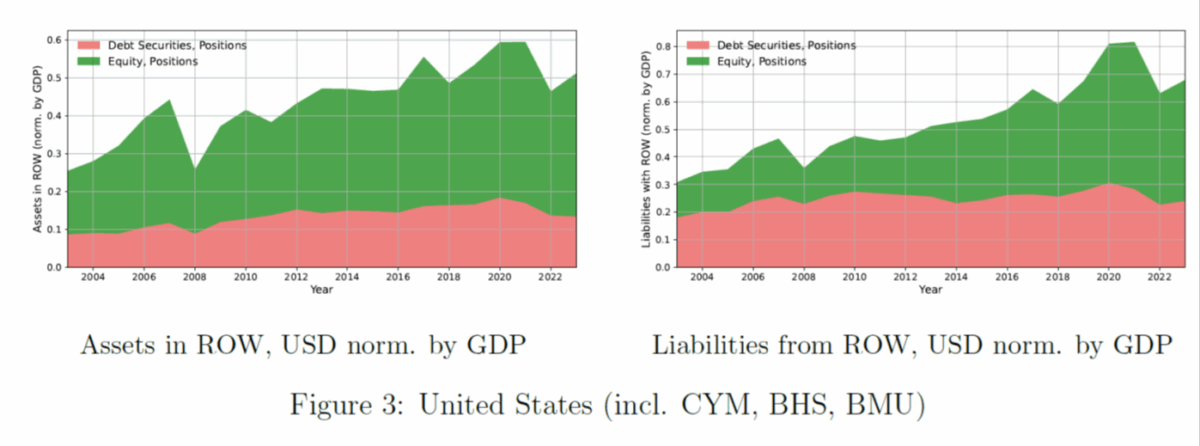

The entire proceedings had been fascinating, together with the commissioned paper by Helene Rey and Vania Stavrakeva (each LBS), entitled “Decoding Turbulent Episodes in Worldwide Finance”. Olivier Jeanne (JHU) and I bought to debate. The paper’s embargoed, however I believe I can share one graph I assumed notably fascinating.

Supply: Rey and Stavrakeva (2025).

The worth of cross-border holdings of equities now exceeds that of bonds (of every type). Therefore, in enthusiastic about determinants of change charges, it appears to me much less believable to rely solely on bond yields as key elements.

I used to be at a convention — truly two — in Singapore: the Asian Bureau for Finance and Financial Analysis annual convention, and the Asian Financial Coverage Discussion board. Within the first, I attended a chat by Steven Davis (Hoover), on “Measuring Coverage Uncertainty, Assessing its Penalties”. One slide just about summed up my emotions about these instances…

The dialogue actually centered on new analysis, relating to jumps in fairness costs and their determinants.

Within the Asian Financial Coverage Discussion board, Adam Posen (Peterson IIE) kicked off the day’s displays, noting the fragmentation into blocs would find yourself dissipating the advantages we loved within the wake of the autumn of the Soviet empire.

Pierre Olivier Gourinchas (IMF Analysis) supplied insights into ongoing work on … geopolitical fragmentation of the worldwide financial system. This shot reveals the divergence between commerce and finance networks.

Apologies for the poor pictures (Good factor I aimed for a profession in economics…).

The entire proceedings had been fascinating, together with the commissioned paper by Helene Rey and Vania Stavrakeva (each LBS), entitled “Decoding Turbulent Episodes in Worldwide Finance”. Olivier Jeanne (JHU) and I bought to debate. The paper’s embargoed, however I believe I can share one graph I assumed notably fascinating.

Supply: Rey and Stavrakeva (2025).

The worth of cross-border holdings of equities now exceeds that of bonds (of every type). Therefore, in enthusiastic about determinants of change charges, it appears to me much less believable to rely solely on bond yields as key elements.