Market unease over potential tariff hikes — and their ripple results on the worldwide financial system — underscores an more and more unpredictable panorama, additional shaken by ongoing inventory market fluctuations.

Whereas monitoring this ongoing volatility, the very first thing to recollect “is to not overreact,” stated Joey Von Nessen, Ph.D., a analysis economist on the College of South Carolina.

Throughout this transitional interval for the U.S. financial system, “typically it’s simple to overreact to one thing you see on the information or in what you are promoting exercise,” he stated. However needless to say “the place we’re right this moment isn’t the place we’re going to be down the street.”

Von Nessen was the visitor on April 14 for PRSA’s Member Mondays webinar. PRSA’s 2025 Chair Ray Day, APR, Stagwell vice chair and Allison Worldwide govt chair, hosts the month-to-month function.

On this surroundings, for unbiased practitioners or those that run small or medium-sized businesses, “it’s all the time vital to be in search of new enterprise and to be diversifying your shopper base,” Von Nessen stated.

Financial notion versus financial efficiency

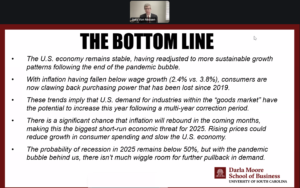

Folks won’t be ok with the financial system right this moment, however in actual fact, “The U.S. financial system continues to be performing effectively, at a B+ degree,” Von Nessen stated. “On most financial metrics, the U.S. financial system stays robust.”

Nevertheless, “there isn’t a lot wiggle room for additional cooling” within the financial system, he stated.

Whereas the financial uncertainty of 2025 has exacerbated the lack of client confidence that began with the pandemic in 2020, the tariffs are usually not prone to elevate unemployment in america, he stated. In response to Von Nessen’s analysis, the chance of recession stays beneath 50%.

And whereas client confidence has been low, client spending has remained steady. Nevertheless, like many elements of the financial system, steady client spending may cause misperceptions.

“Since Could of 2021, when inflation began rising, the majority of the spending development was amongst high-income households,” which symbolize about one-third of all American households, Von Neesen stated. “The opposite two-thirds of U.S. households have pushed the lack of client confidence.”

The excellent news concerning the financial system general, Von Neesen stated, is that “There was vital progress during the last 12 months. Wages have been rising quicker than costs. Customers are clawing again the buying energy they’d misplaced to inflation.”

Held on the second Monday of each month, the information-sharing Member Mondays can be found to PRSA members and nonmembers and concentrate on subjects of curiosity to the communications career. There may be one other session on the fourth Monday of each month for PRSA leaders at Chapters, Districts and Sections, specializing in best-practice sharing and progress on PRSA’s Strategic Plan. Discover extra info right here.

Watch a replay of the April 14 session beneath:

Photograph credit score: thananatt