In its newest International Commerce Replace, launched this week, UNCTAD describes copper as “the brand new strategic uncooked materials” on the coronary heart of the quickly electrifying and digitising world financial system.

However with demand set to rise greater than 40 per cent by 2040, copper provide is underneath extreme pressure – posing a essential bottleneck for applied sciences starting from electrical autos and photo voltaic panels to AI infrastructure and sensible grids.

Extra than simply steel

“Copper is now not only a commodity,” stated Luz María de la Mora, Director of the Worldwide Commerce and Commodities Division at UNCTAD.

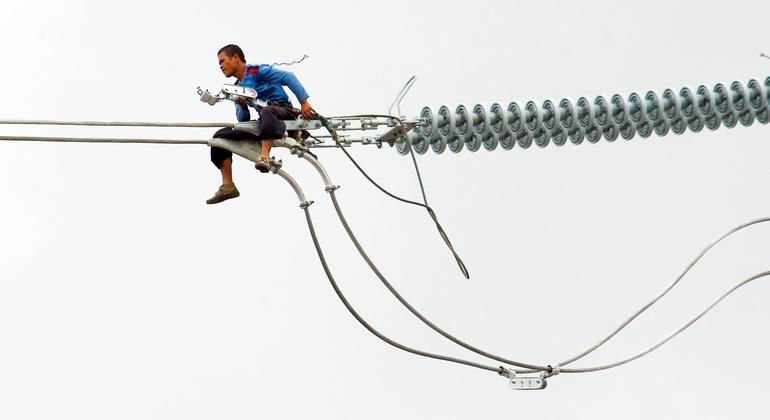

Valued for its excessive conductivity and sturdiness, copper is important to energy methods and clear power applied sciences. It runs by way of houses, vehicles, knowledge centres and renewable infrastructure.

But growing new mines is a sluggish and costly course of, and fraught with environmental dangers – usually taking as much as 25 years from discovery to operation.

Assembly projected demand by 2030 might require $250 billion in funding and at the very least 80 new mining tasks, based on UNCTAD estimates.

The Democratic Republic of the Congo holds a number of the world’s largest copper reserves, but many of the steel is exported, limiting the nation’s potential to learn absolutely from this helpful useful resource.

Uneven geography, unequal good points

Over half of the world’s recognized copper reserves are concentrated in simply 5 nations – Chile, Australia, Peru, the Democratic Republic of the Congo and Russia.

Nonetheless, a lot of the value-added manufacturing happens elsewhere, significantly in China, which now imports 60 per cent of worldwide copper ore and produces over 45 per cent of the world’s refined copper, says the UN.

This imbalance leaves many growing nations caught on the backside of the worth chain, unable to completely profit from their assets.

“Digging and transport copper shouldn’t be sufficient,” the report states.

“To maneuver up the ladder, copper-rich growing nations should spend money on refining, processing and manufacturing – this implies strengthening infrastructure and abilities, establishing industrial parks, providing tax incentives and pursuing commerce insurance policies that assist higher-value manufacturing.”

Tariff and commerce limitations

UNCTAD additionally highlights the problem of tariff escalation, the place duties on refined copper are comparatively low – usually beneath two per cent – however can rise to as excessive as eight per cent for completed merchandise like wires, tubes and pipes.

These commerce limitations discourage funding in higher-value industries and lock nations into roles as uncooked materials suppliers, the report warns.

To handle this, UNCTAD is urging governments to streamline allowing, cut back commerce restrictions, and develop regional worth chains to assist growing economies climb the commercial ladder.

Scrappy answer

With new mining tasks dealing with lengthy lead occasions, recycling is rising as an important a part of the answer.

In 2023, secondary sources accounted for 4.5 million tonnes – almost 20 per cent of worldwide refined copper output. The USA, Germany and Japan are the highest exporters of copper scrap, whereas China, Canada and the Republic of Korea are main importers.

“For growing nations, copper scrap could possibly be a strategic asset,” UNCTAD notes.

“Investing in recycling and processing capability can cut back import dependence, assist value-added commerce and advance a extra round, sustainable financial system.”

Take a look at case for essential supplies

Copper, UNCTAD says, is a probable “check case” for a way world commerce methods deal with rising demand for essential supplies amid rising pressures.

“The age of copper has arrived…however with out coordinated commerce and industrial methods, provide will stay underneath pressure and lots of growing nations danger lacking out,” the report concludes.